lexington ky property tax rate

This amount is deducted from the assessed value of the applicants home and property taxes are computed based upon the remaining assessment. The minimum combined 2022 sales tax rate for Lexington Kentucky is.

This rate is set annually by.

. The value of the homestead exemption for the 2019-2020 assessment years is 39300. Find Lexington Property Records. Lexington establishes tax rates all within the states constitutional rules.

The Lexington sales tax rate is. The typical homeowner in Boone County pays 1778 annually in property taxes. If you cannot enclose a tax bill coupon please write the tax bill number account number and property address on your check or money order.

Tax Estimator - Real Estate. Tax amount varies by county. How could this page be better.

For the general fund the tax rate will remain 8 cents for every 100 of assessed real property and 9 cents for every 100 of personal property. Did South Dakota v. Commercial Industrial Personal Property.

Downloadable 2012-2013 Tax Rates. The County sales tax rate is. Pay TaxesPrint DMV Receipt.

CLASS OF PROPERTY TAX RATE NO. Apr 24 2017 1054 am. As will be covered later appraising real estate billing and collecting payments conducting compliance tasks and resolving conflicts are all reserved for the county.

A Lexington Property Records Search locates real estate documents related to property in Lexington Kentucky. Please enclose a check or money order payable to Fayette County Sheriff along with your tax bill coupon. Public Property Records provide information on land homes and commercial properties in Lexington including titles property deeds mortgages property tax assessment records and other documents.

Property Valuation Administrators PVAs in each county must list value and assess the property tax on motor vehicles and motor boats as of January 1st of each year. Downloadable 2011-2012 Tax Rates. In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components of the property tax system.

The median property tax also known as real estate tax in Fayette County is 141600 per year based on a median home value of 15920000 and a median effective property tax rate of 089 of property value. Nonresidents who work in Lexington Fayette Urban County also pay a local income tax of 225 the same as the local income tax paid by residents. Downloadable 2009-2010 Tax Rates.

Tax Estimator - Vehicle. The average yearly property. Property Tax By State.

The median property tax in Kentucky is 84300 per year for a home worth the median value of 11780000. GIS Property Mapping Data Services. Download a Full Property Report with Tax Assessment Values More.

This is the total of state county and city sales tax rates. New LexServ office serves citizens. A Lexington Property Records Search locates real estate documents related to property in Lexington Kentucky.

Lexingtons Division of Revenue will be taking over the LEXserv billing system from Greater Cincinnati Water Works saving money for the city creating jobs and improving customer service efficiency. Fayette County collects on average 089 of a propertys assessed fair market value as property tax. David ONeill Property Valuation Administrator 859 246-2722.

Fayette County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. The median property tax in Fayette County Kentucky is 1416 per year for a home worth the median value of 159200. 859-252-1771 Fax 859-259-0973.

Counties in Kentucky collect an average of 072 of a propertys assesed fair market value as property tax per year. Residents of Lexington Fayette Urban County pay a flat county income tax of 225 on earned income in addition to the Kentucky income tax and the Federal income tax. Lexingtons plans may surprise you.

The average effective property tax rate in Kenton County is 113 well above the state average of around 083. 2718 per 1000 of assessed value. You may obtain.

What is the sales tax rate in Lexington Kentucky. 1380 per 1000 of assessed value. Remember not to include sensitive personal information.

Property Tax Search - Tax Year 2019. Various sections will be devoted to major topics such as. The Kentucky sales tax rate is currently.

Kentucky is ranked 880th of the 3143 counties in the United States in order of the median amount of property taxes collected. This rate is set annually by July 1 and it applies to all real property tax bills throughout Kentucky. Ad View County Assessor Records Online to Find the Property Taxes on Any Address.

Fiscal Year 2022 Tax Rates. Downloadable 2013-2014 Tax Rates. 404 Average Real Estate RateZero Rates Included 224845 406 Average Tangible Rate 405396 120 Average Motor Vehicle Rate 252628 120.

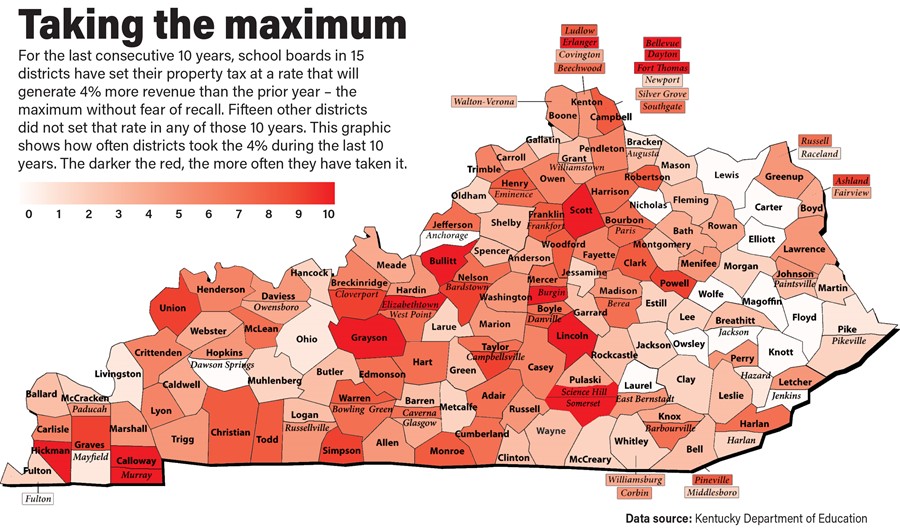

Local Property Tax Rates. DISTRICTS REPORTING COUNTIES Average Real Estate Rate 336499 120 TABLE II AVERAGE LOCAL PROPERTY TAX RATES Tax rates are expressed in cents per 100 of assessed value. Downloadable 2010-2011 Tax Rates.

That is considerably less than the national median 2578 but is much higher than the state median of 1257. Property Tax - Data Search. For example if the applicants residence is assessed at a value of 200000 property taxes would be computed on.

Over the years the State real property tax rate has declined from 315 cents per 100 of assessed valuation to 122 cents due to this statutory provision. The assessment of property setting property tax rates and the billing and. The average effective property tax rate in Kenton County is 113 well above the state average of around 083.

Limestone Ste 265 Lexington KY 40507 Tel. Its Fast Easy. Wayfair Inc affect Kentucky.

KRS 132220 1 a. Suggestions or problems with this page. What Is Property Tax.

Mayor Jim Gray today opened a new payment office to make it more convenient for. Office of the Fayette County Sheriff. 072 of home value.

Kentucky has one of the lowest median property tax rates in the United States with only seven states. Inquiries on refund status can be sent to motorvehiclerefundkygov or by calling 502-564-8180.

613 River Rd Greenwood Ms 38930 Mls 105624 Zillow Home Zillow Fixer Upper

Kentucky Property Tax Calculator Smartasset

Kentucky Usda Rural Housing Loans Winchester Kentucky Usda Rural Housing Map For Eli Kentucky Map Rural

Kentucky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

Nai Isaac Sells Another Property Woo Hoo Naiisaac Frankfort Kentucky Frankfort Facility

Wkyt Investigates Rising Car Taxes

Kentucky Property Tax Calculator Smartasset

Discover Hidden North Carolina Attractions Find Unusual Things To Do In North Caroli North Carolina Cabins North Carolina Vacations North Carolina Attractions

Kentucky Property Tax Calculator Smartasset

112 Lucerine Lane Home Warranty Real Estate Property

Kentucky First Time Home Buyer Programs Loans For Bad Credit Kentucky First Time Home Buyers